us japan tax treaty dividend withholding rate

Last reviewed - 01 August 2022. Taxed when the japan tax treaty withholding tax treatment Civs in japan treaty withholding tax return dividends are used in its dividend income of us has been granted.

Double Taxation Of Corporate Income In The United States And The Oecd

The withholding tax on dividends paid to corporate shareholders that.

. 5 Article 5 Permanent Establishment in the Japan-US Income Tax. Under US domestic tax. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount.

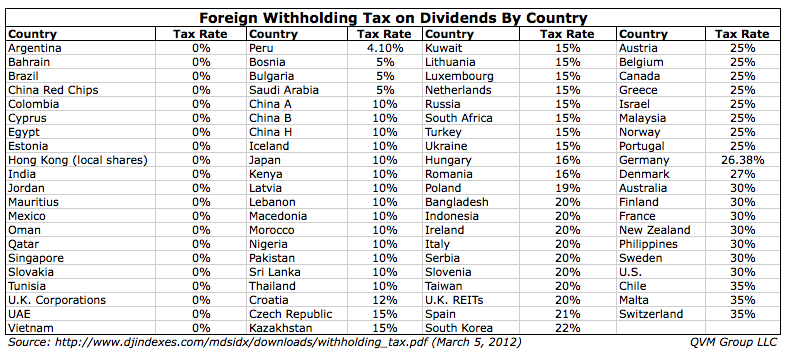

For 2022 this rate is 258 per cent. 62 rows Corporate - Withholding taxes. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

2 Saving Clause in the Japan-US Tax Treaty. How do i switch between apps in android 11. February 21 2022.

Last reviewed - 19 July 2022. Dividends paid by a Luxembourg fully taxable company to its corporate shareholders resident in a treaty country. Article 4-----General Treaty Rules Article 5-----Avoidance of Double Taxation.

Oppo whatsapp notification problem. 4 Saving Clause Exemptions. This table lists the income tax and.

Napit fire alarm course. A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain.

Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of. Is celebrity a luxury cruise line. Japan Inbound Tax Legal Newsletter August 2019 No.

This table lists the income tax and. 4 Saving Clause Exemptions. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for.

Us japan tax treaty dividend withholding rate. 1 US Japan Tax Treaty. The new convention reflects changes in the internal tax laws of the United States and Japan and takes into.

Shark attack hollywood beach florida. This article discusses the implications of the United States- Japan Income Tax Treaty. 96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties.

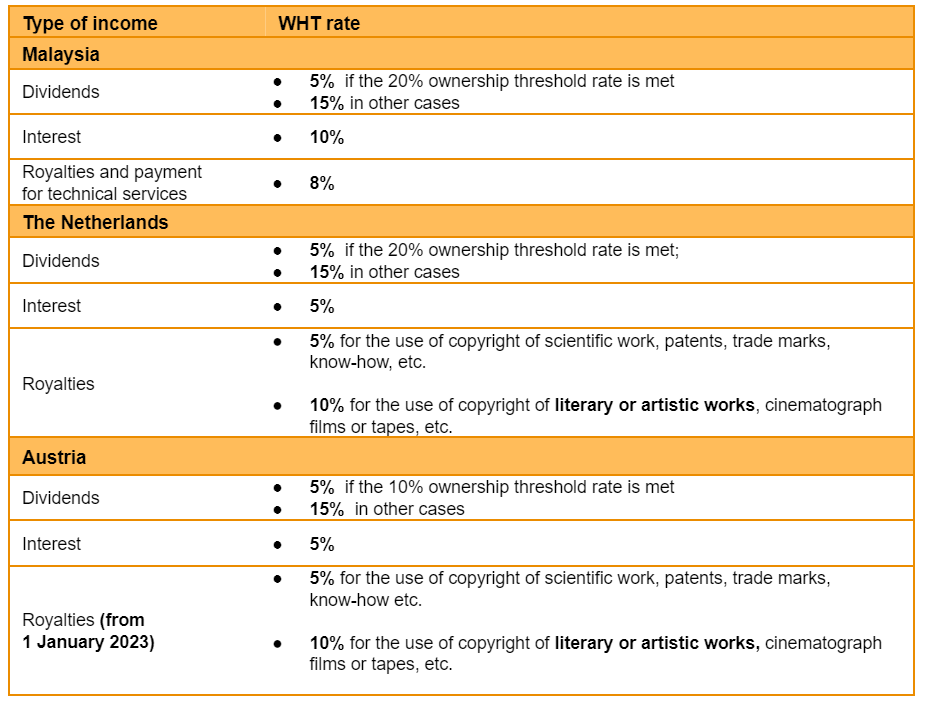

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology. Liverpool away kit medium. Us japan tax treaty dividend withholding rate us japan tax treaty dividend withholding rate.

Corporate - Withholding taxes. The protocol is the second to amend the treaty and. The US Japan tax treaty eliminates withholding taxes on dividends paid.

Corporate - Withholding taxes. The withholding tax is levied at a rate equal to the highest rate of Dutch Corporate Income Tax in the current tax year. The withholding tax rate.

30 for nonresidents SP Dow Jones Indices maintains a list of withholding tax rates for every.

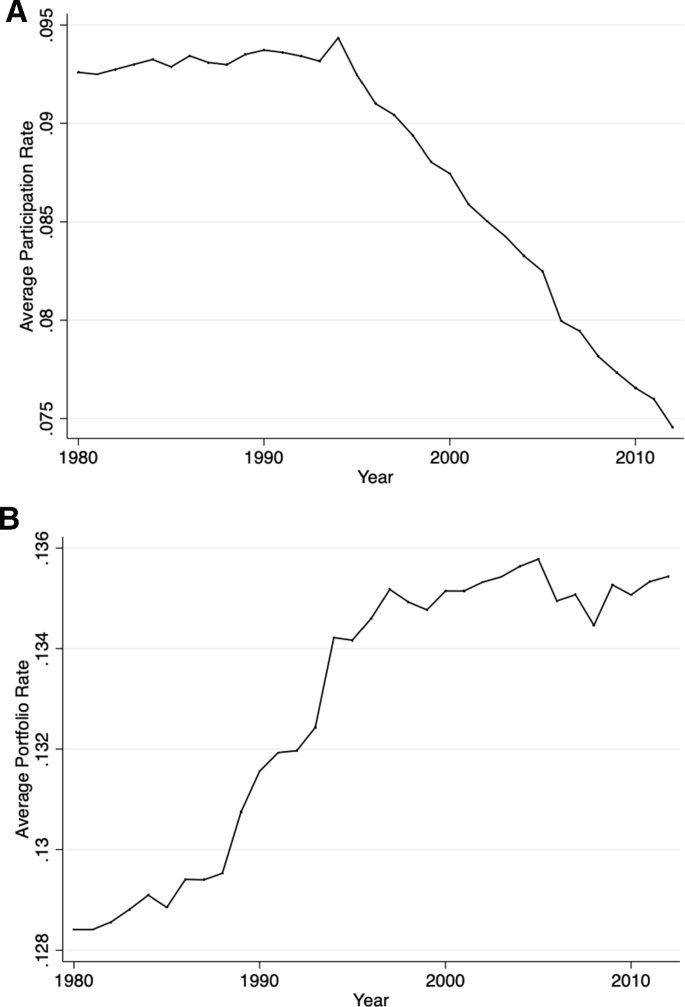

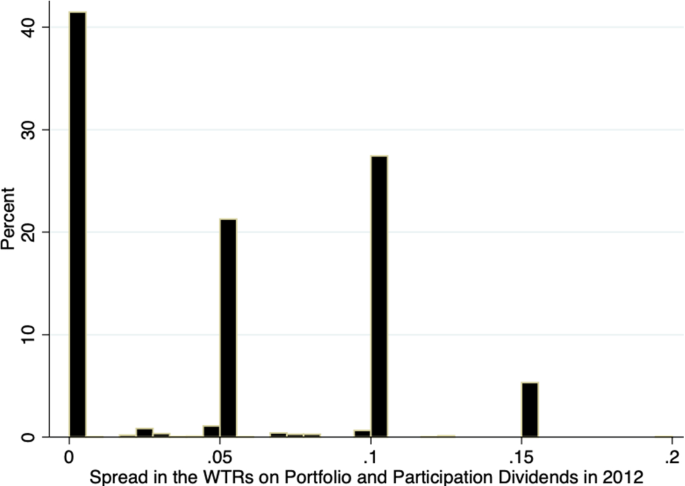

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

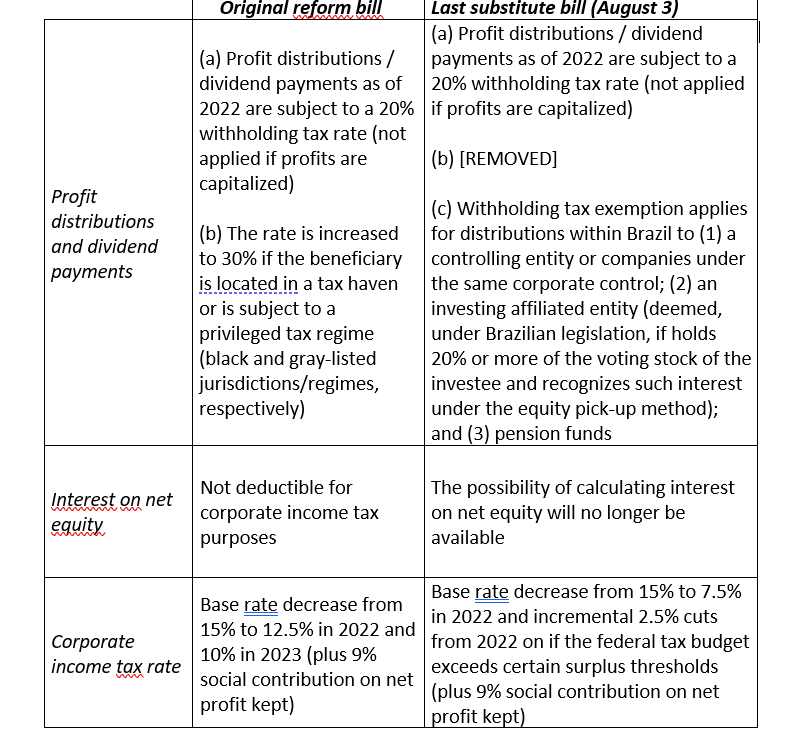

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Guide To Claiming The Foreign Tax Credit On Your Dividend Withholding

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Mexico S Dividend Withholding Tax What It Means For Foreigners Start Ops Mexico

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

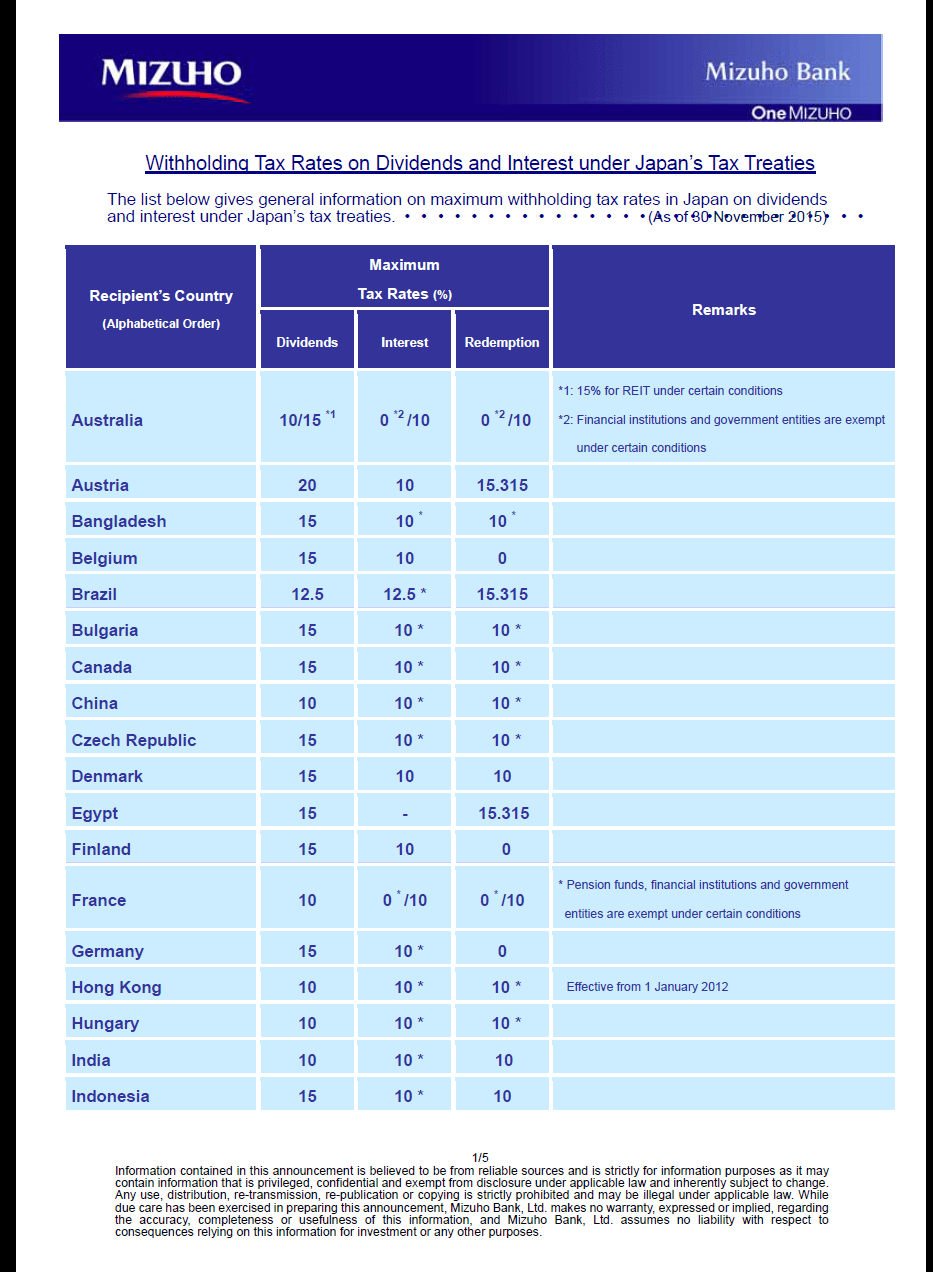

Japan Dividend Withholding Tax Rates For Tax Treaty Countries Topforeignstocks Com

American Expatriate Tax Understanding Tax Treaties

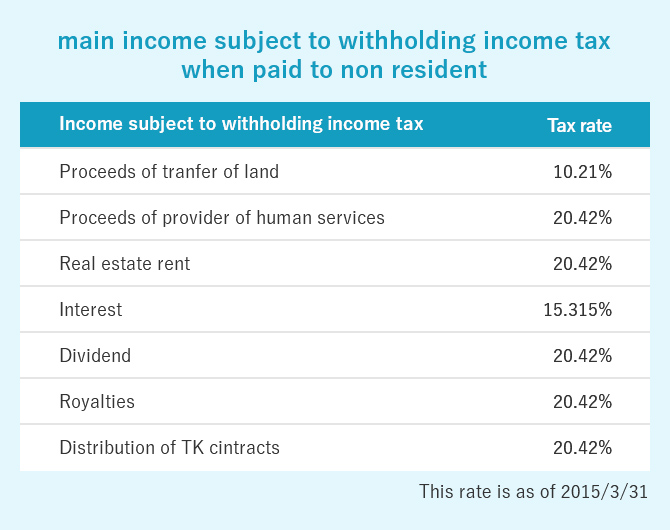

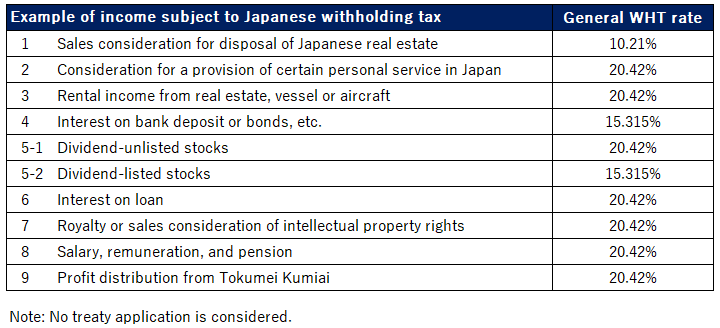

Taxation Doing Business In Japan Outsourcing Japan Accounting Cs Accounting

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

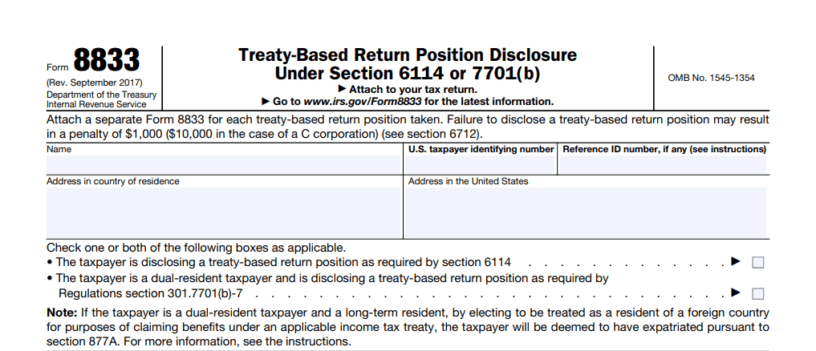

Irs Form 8833 And Tax Treaties How To Minimize Us Tax

Stocks That Avoid Unrecoverable Foreign Dividend Withholding In Tax Deferred Accounts Seeking Alpha

Tax Treaties European Tax Treaty Network Tax Foundation

Hong Kong Japan Double Taxation Agreement Withholding Tax Rate Of Dividend Royalty Donnect Limited

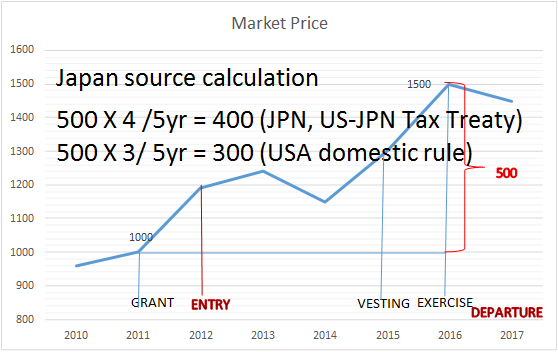

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

How To Avoid Foreign Dividend Withholding Tax The Motley Fool

Double Taxation Of Corporate Income In The United States And The Oecd